RIP Social Security

Four things millennials should know about social security, before they’re old and screwed.

As we see our government and society change in many different aspects, we as millennials should know the importance of questioning our financial security in the long run. While it’s easy to want to spend a little extra and “treat ourselves,” we must also maintain our well being by paying attention to our retirement plans since we can’t be relying on the government to help us, unlike baby boomers and those before them have.

Luckily, this guide is here to help. Here’s a look at the condition of Social Security in present time, what we can expect from it as millenials, and how you can be sure to have that money flowing even in the coming future.

1. What is Social Security anyways?

Social Security was created to be a foundation in the lives of Americans for those who were not just retired, but those who are disabled, the family of those disabled, or deceased workers. It was intended to to help people rely on company pensions and social security for when we grew up, but as millennials we are not getting a piece of that pie.

According to the article “Here’s What Social Security Will Look like by the Time Millennials Retire,” Ashely Redmond states, “This year is the first time millennials are expected to surpass baby boomers as the largest segment of the workforce, one-third- according to the Pew Research Center.”

This holds significance because for so long social security was designed by our government to give aid to those Americans who are of old-age. This also effects the hard workers who are no longer able to work harsh conditions, along with those who are disabled or injured, since social security provides a paycheck to maintain survival.

2. Where does Social Security stand as of now?

According to Jaime Hopkins, a professor at The American College’s Retirement Income Program, he states, “Social Security will change because it is unsuitable at its current rate.”

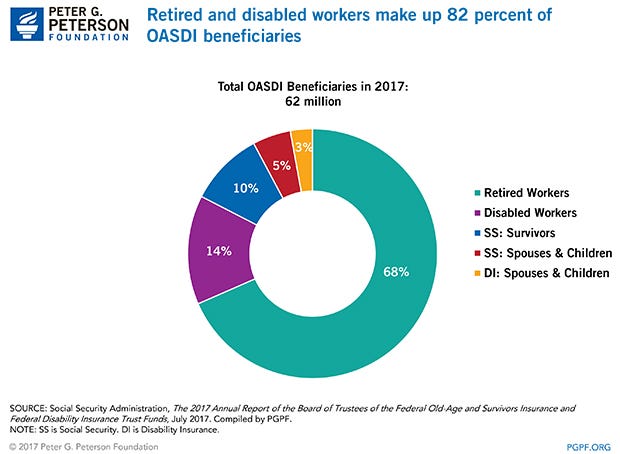

We can see the full picture of that when we look at the decisions of the Social Security Administration that announced in October of last year that it will make annual changes which started Jan. 1, 2018. We are expected to face 66 million Social Security beneficiaries and will see a 2% cost of living adjustment (COLA). This is done to counteract the inflation. This will ensure that those beneficiaries will still have the same buying power they did for the previous year.

3. There are over 300 million people in the US and that number will continue to grow. Will this be what causes an end to Social Security?

Even though this may be beneficial to those who receive Social Security as of now, it does not speak for millennials. The age for retirement is actually increasing and will continue to increase. The oldest millennials who are now 37 years old will start retiring in about 30 years, and the youngest millennials who are now 22 will start retiring in approximately 46 years.

As time goes on and we get older it will be more difficult for the government to aid retirement plans with such a vast population. It would be in millennials best interest to start saving money for retirement on their own rather than relying on social security from the government.

4. Who should millennials turn to when saving their retirement?

In an article titled, “Will Millennials Be Able to Use Social Security?” Miriam Caldwell states, “The easiest way to save for retirement is to work your way up to saving 15 percent of your income for retirement each year. This would include your employer match if you have one. You can invest in the retirement plan through your job, which will likely be a 401k or a 403b.”

This type of security will make the most difference when reaching your time to finally settle down and be free from work. By that time in your life you will not want to be worrisome, but relieved that you made responsible choices while still working.

Now you might be thinking, “Why should I bother paying my taxes still?” Well, everyone has to pay taxes toward social security, even though it does not have the same stability it did for many generations for millennials, but the also this program still does good for those in need.

Another thing is while all of this may sound intimidating, millennials have been able to endure massive reform from natural disasters, recessions, and other major law changes. Our generation can handle anything, even this.